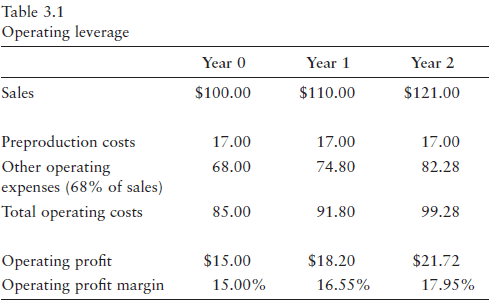

Operating leverage refers to the degree of which a change in revenue corresponds to a change in operating income (EBIT). Should a business grow revenues 10% in a year but experience EBIT growth of 20%, it would be a plausible conclusion to assume the business exhibits high operating leverage. Operating leverage arises when fixed costs dominate the total cost structure – meaning there is little to no incremental costs related to sales growth.

You can also see operating leverage in the form of preproduction costs. To provide products and services there is almost always some form of cash outlays beforehand. These outlays have the effect of reducing operating margins before recognition of sales, which will eventually lead to higher EBIT margins down the line.

In Michael Mauboussin’s book, Expectations Investing, he explains that the timing and magnitude of these costs differ by business. Industries that rely on physical capital need these costs to sustain their growth at some desired capacity level. While companies that rely ‘knowledge assets’ will put these costs in the form of R&D to protect themselves from future obsolescence.

Below are two examples of operating leverage that have been in my mind as of late.

Disney & Media:

I believe Disney’s (all of the studios, really) transformation into a streaming business is the most intriguing example of operating leverage. Before the proliferation of streaming, studios would put growing amounts of capital into the production of content assets. The studios would then go around to leverage this newly created asset to multiple vendors. That is they would sell/license the rights to theatres, then to hotels, airlines, DVDs, cable, broadcast TV, and for a time streaming platforms. At each step, selling the rights to these vendors was effectively 100% margin. The costs were already expensed at the preproduction time – there is no need to rerecord a movie for that will be shown in a hotel versus on an airplane.

Streaming has caused studios to leave this highly profitable model with the hope of being winner the of the content aggregation race. To do so, studios have made some of the prized content exclusive to their platforms and forgone free EBIT dollars. The push to a direct-to-consumer model has destroyed all the different streams of income that were previously realized by the studios for their content. If you can watch the next Marvel movie as soon as it comes out on your phone, there will be no need for Disney to license the rights to all the vendors they once did, eliminating other profit opportunities. Streaming still has its share of operating leverage but not at the same level of the past model. There are other benefits to streaming some would point out. For one, it gives Disney direct access to the end-customers viewing experience – a marriage that has rarely if ever been achieved. With so much competition in the space, it remains to be seen how profitable the winners of the race will be and to what degree will consolidation play a role in both content & aggregation.

Marketplace Businesses:

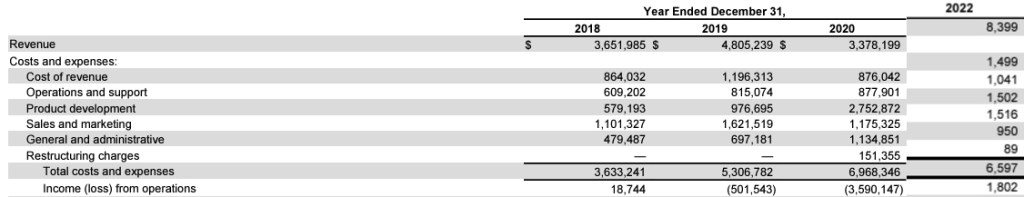

Another place to find the effects of operating leverage is in businesses with two-sided network effects (e.g., Airbnb). These businesses will rely on marketing expenses early on in their life cycle to grow their user bases before turning into the de-facto marketplace (or network) for the services they provide. Since these businesses tend not to rely on variable costs as much, when their sales grow their marketing costs as a percent of revenue drops – as user base grows they need not spend on acquiring new users, the network itself becomes self sustaining.

Airbnb is one of the best examples of the effects of operating leverage on EBIT margins. In 2018 the company spent $1.1B on marketing & sales expenses on sales of $3.4B. The company was spending ~31% of sales to finance future customer acquisitions. In 2022, Airbnb then went on to spend $1.5B on marketing, but completed so on sales of $8.4B. That 30% figure has now dropped down to ~18%. For these types of businesses it doesn’t matter whether the gross booking value is $29B or $63B (as they were in 2018 & 2022 respectively), the costs do not change all that much at either amount. In that same time period the Airbnb’s EBIT margin went from <1% to 21.5% – an improvement of ~2,100 basis points.

Takeaway:

One of the easiest mistakes to make when evaluating businesses is to put too large an emphasis on historical information. As illustrated above it is possible that when evaluating a business the operating margins may have some downward pressure arising from these early stage costs. By considering the effects of operating leverage and the competitive position of the business you may come up with some informed estimate of what margins should look like in a normalized environment. After normalizing margins, you may then find that the business is far more attractive than at first glance.

Like investments, the best businesses are those that are able to generate more cash than invested into the business. Recognizing that a business has downward pressure on margins before the market is able to will put you in the position needed to capitalize on that future inflection point. It is all about finding where revisions in market expectations are needed – and a substantial change in EBIT margins will have a similar effect on business valuation.

[…] Valuations – Gogo Pitch Managerial Case Study – Tom Murphy Understanding Multiples Operating Leverage & Margins TSMC Pitch Railroad Industry Primer Emirates Driving Company Pitch Discounting & M.O.S Google […]

LikeLike