The Emirates Driving Company (EDC) is the exclusive provider of pre-license services in Abu Dhabi, a privilege the business has had since its inception, 23 years ago.

Licenses in the country work like so. Residents looking to obtain their first license must take part in theory classes, simulator training, and practical training at the EDC. However, there are a residents who are able to bypass the trainings, and the EDC completely, should they have a license from a foreign country (of a list of 43) that can be exchanged directly for an Emirati license. Residents who have licenses from other countries (that aren’t exchangeable on demand) can look at a new scheme by the roads & transport authority (RTA). This scheme allows for this group to have the opportunity of a one-time practical test by the licensing authority (in Abu Dhabi, that would be the police). Should one fail the one-time offered exam, then they must attend practical training at the EDC or other pre-licensing services in other parts of the country.

43 Exempted Countries:

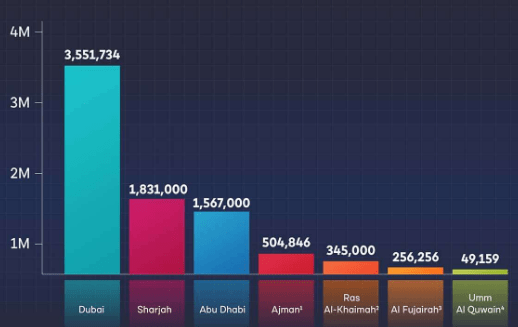

I’ve attached a picture of the 43 exempted countries at the end of this post. Below is an image of the breakdown of the UAE’s population by nationality. What you’ll notice is that 8 of the largest foreign nationality groups in the country are unable to exchange their foreign licenses (should they have one) for an Emirati license.

Geography

The United Arab Emirates (UAE) is comprised of 7 emirates, one being Abu Dhabi. Abu Dhabi is the 3rd largest emirate by population, behind Dubai & Sharjah. The population of the UAE is roughly 10 million, of which 85%+ are immigrant. The population of Abu Dhabi is ~1.5 million (compared to Dubai’s 3.5 million & Sharjah’s 1.8 million) with the immigrant population accounting for 80%+ of the population.

Operations

The business has taken full advantage of its unique position and has been able to grow free cash flow at a 12% CAGR over the past 6 years, from AED 102 million to AED 200 million in the last fiscal year. The business commands impressive margins that have expanded in recent years. The gross margins are 80%, operating margins – 60%, and free cash flow margins – 57%. In 2017 the margins were 75%, 40%, and 42%.

In the space of six years, the operating margin has expanded by 2000 percentage points. If that is not sign of the operational capabilities of management, then I do not know what is.

Allocation

The management team has proven to be adept at operations and capital allocation. Their capital allocation strategy of choice has been to return cash to shareholders through dividends (payout ratio oscillates at around 50%). The country levies no income tax so shareholders get all the cash directly. There is no debt to pay down. There has been continued investment into the core business and no issuances of shares.

Digging into the past there was one specific act by the ‘previous’ management team I couldn’t help but admire. In 2019-20 they divested Qeyedah Driving – reducing their revenues, earnings, and overall size. In the 2019 annual report, they offered the details of the unit for the then past two years (see image below). The unit was returning a poor 5% on capital as of 2019. The decision to divest the unit informs me of a focus on value creation by the management team; an essential ingredient to long-term success for the continuing shareholder.

To add, the business has been able to report stellar returns on capital. In 2017, the business boasted a return on invested capital of 25% and a 16% return on equity capital. As of the end of 2022 the company’s ROIC was 48% and its ROE was 21%.

Valuation:

Today, the company trades for AED 26 per share or a market cap of AED 2.37 billion. The business has AED 562 million in cash on the balance sheet (or AED 6 per share) and an additional 111 million of financials assets. The absence of debt on the balance sheet gives the company an enterprise value of 1.8 billion. In the last fiscal year, the company earned 200 million in free cash flow – resulting in a EV/FCF of ~9 times. In other words, the business earns a free cash flow yield of 11% at current prices. Of which it pays AED 1 per share in dividends yearly – a cash return of 5%, ex-cash.

Absent growth – which has historically been at 12% – I would make my money back within 10 years. Assuming cash flows grow at 12%, I would make it back within 7 years.

Note – The conversion rate between an AED & the US dollar is fixed at $1 = AED3.6725.

Opportunities

I believe the future of the company will not be too dissimilar to its past. Recent revenue growth is 6% – as long as they can keep their moat, pricing power will not magically disappear and thus I expect the future to be more of the same.

I also expect a moderation in capital investment within the next three years. Recent capital expenditures have been unusually large due to the construction of a new facility in Abu Dhabi and a push to electrify their fleet. The push to electrify the fleet will be ongoing but the costs of construction are likely to finish this year. Reduced capital expenditures will free up extra cash that will be distributable to shareholders.

On the operational front, I expect more of the same when it comes to margins. The work that has been done to improve margins much like revenue I expect to be unchanging with minute improvements. In the company’s 2022 sustainability report they revealed that there has been an increase of 60% – as compared to the year prior – of the number of students who used the e-learning platform. Further digitization reduces frictional costs and improves the margins of the business.

The last opportunity that could make a real difference in creating shareholder value revolves around the company’s cash pile. There is just short of AED700 million of cash and financial assets on the balance sheet of which is AED562 million in cash – roughly a fourth of equity value. As per statements from the company’s management it seems they’ve been eyeing potential acquisitions and dividends as the potential use of this cash. They recently invested AED9.8 million into the Saudi-based Consultants Driving School in the form of convertible notes, it remains to be seen how this investment will unfold.

Premortem

To stimy optimism it makes sense to look at what could go wrong. I’ve listed a few of these possibilities down below:

- Liberalizing Policy – As mentioned earlier, there is a list of the 43 countries that are allowed to directly convert their issued licenses into Emirati licenses. This list was once 33 and even less before that. Should the list keep expanding and capture the countries that make up the majority of the immigrant population I don’t believe the business has the same level of attractiveness it once had.

- Tax Policy – Starting this year the country will introduce its first corporate tax policy. Businesses earning upwards of AED375,000 will be charged a 9% tax rate on the above amounts. Taxes reduce the cash available for shareholders and the start of this new tax policy will reduce the amount of cash that is distributable to the shareholder. Any further increases in the rate will have a negative effect on the continuing shareholder.

- Immigration – The country relies heavily on immigration to grow its population. Should a change in taste reduce the attractiveness of Abu Dhabi as a destination for foreigners, it becomes that bit harder to get consumers through the doors.

- The Far-Fetched – These last two are a bit far-fetched in terms of the timeline of which they could be realized. A shift into autonomous driving – should it mean ‘drivers’ require no licenses & the UAE (Abu Dhabi) revising their urban planning policies. Today, the country is very much reliant on personal vehicles and less so on public transport. On autonomous driving, I don’t know when the time will come for mass adoption let alone not requiring a license but should that day occur soon it will surely adversely affect the business.

Ownership Structure

Before concluding, I’ll add a bit on who owns the company. The International Holding Company is the largest shareholder with an indirect ownership stake of 48%. Their stake comes from their subsidiary, the Multiply Group, who directly owns an 11% stake in EDC and through their subsidiary, Spranza, they own an additional 37% stake in EDC. Other large shareholders own around 5-6% of the shares and are mostly investment funds. Major institutional ownership works out to around 70% of shares.

Conclusion

To briefly conclude, the company has been able to use its unique position as the exclusive provider of pre-license services in Abu Dhabi to improve the economics of the business through time. The business has 40% of its market cap in cash, steady but high margins, increasing returns on capital, and importantly trades at an 11% free cash flow yield. An easy to identify moat with proven durability has enabled the business to thrive the way it has in recent years and may just be the reason as to why it will continue to do so. They could also face worsening economics in the future from liberal policies, taxes, and more.

Note: Picture of the 43 exempted countries, per TheoryTest.AE

[…] Understanding Multiples Operating Leverage & Margins TSMC Pitch Railroad Industry Primer Emirates Driving Company Pitch Discounting & M.O.S Google Pitch Share Repurchases BV v. IV Importance of Returns on Capital […]

LikeLike