High price to earnings ratios tend to be associated with expensive share prices. But is this true? When looking at a P/E ratio in isolation high multiples don’t seem all that appealing and may result in subpar investment returns. When comparing a large and diversified list of stocks, low P/E names tend to outperform higher P/E stocks on average. But on an individual level, the fundamental makeup of companies is what should truly decide a firm’s per-share price relative to its current earning power. The price to earnings ratio doesn’t have much to do with valuation other than providing a hint as to when cash may flow into the business.

The value of a company rests on the discounted value of future cash flows generated by the business. This figure is completely independent to TTM earnings numbers and the price to earnings ratio of a stock. A more appropriate metric to look for in a business is the return on invested capital. The importance of maintaining a high ROIC is best summed up by Charlie Munger when he said:

In the short term, the per-share price of a stock can fluctuate erratically but as an investor continues to hold their shares over the long term it will match the internal returns of the business. As for the business, the best way to increase the per share intrinsic value of the firm is to retain a substantial percent of their earnings and reinvest those earnings at a high rate of return (if possible). The very few businesses that can guarantee high returns on incremental capital over an extended period will undoubtedly outperform the market. These types of businesses require durable competitive advantages to achieve such results. There are only a handful of businesses that fit this profile – many will promise these returns but are unlikely to realize them.

An example of one of these businesses is Skyworks Solutions. Let’s see how an investment in the business would’ve fared from 2011-2021.

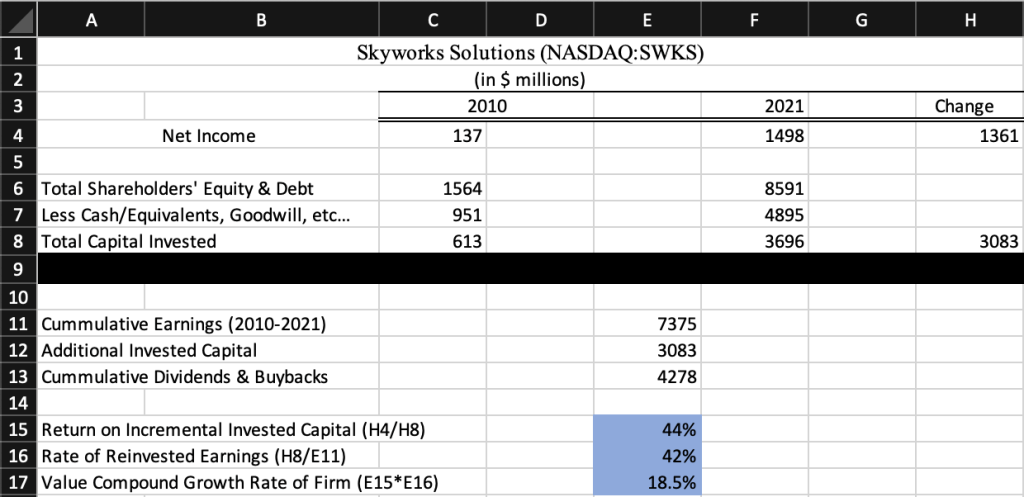

In 2010, Skyworks Solutions earned $137 million in after-tax profits on $613 million of capital (minus cash, cash equivalents, goodwill, and intangibles), a return of 22%.

Fast forward to 2021, Skyworks then earned $1.49 billion in after-tax profits on $3.7 billion of capital, a return of 40.5%.

Over the 10 years, profits have increased by $1.36 billion while the company has invested an additional $3.1 billion of capital. Therefore, Skyworks’ return on additional capital employed over the 10-year period is a whopping 44%. Over the period, you can estimate that Skyworks reinvested about 42% of its earnings. By dividing the $3.1 billion of additional capital with the cumulative earnings of the period you get an estimate of the percentage of earnings reinvested into the business. Meaning for every $100 of earnings generated by Skyworks, $42 was reinvested in the business and $58 was distributed back to shareholders as dividends and/or share repurchases.

The value of the business should also over time compound at the rate at which the product of the percent of earnings reinvested and the firm’s return on invested capital equals. For Skyworks that would be a per-share compounded growth rate of 18.5% (.44*.42) and higher due to buybacks and dividends.

Skyworks Solutions stock closed on the 31st of December 2010 at a price of $28.63. 10 years later, on the same day, the stock closed at $152.88, a CAGR of 18.24% (excluding dividends), not too far off the estimated per-share growth rate using the return on incremental invested capital. Unless there is a substantial expansion in multiples, businesses with low returns on capital will see their shares match their rate and provide unsatisfactory results for shareholders.

The best kind of businesses can reinvest a substantial amount of their earnings at high rates of return for long periods of time until large numbers eventually drag down results (like the DJ Khaled album, Suffering from Success). Another great business is one that provides high rates of return but only on a small portion of reinvested earnings (a Coca-Cola or See’s Candies for example). These businesses should end up sending shareholders/owners most of their earnings or risk destroying shareholder value as the capital can no longer be deployed intelligently. By sending excess earnings to shareholders, the owners can reinvest that capital in other enterprises with more enticing opportunities. The worst businesses on the other hand require large amounts of capital to get a return that is just satisfactory (airlines). To quote Richard Branson, “the fastest way to become a millionaire in the airline business is to start out as a billionaire”.

Many other alterations can be made to find the ‘right’ numbers to calculate a firm’s return on capital. But the 2 types of businesses where owners are treated to exceptional results are very rare to find. This key metric in my opinion is more likely to tell you about the value of a business as opposed to a firm’s price to earnings ratio. The value of a business relies on future assumptions of cash flows not past earnings.

For more reading on the topic: https://www.berkshirehathaway.com/letters/1992.html. https://sabercapitalmgt.com/calculating-the-return-on-incremental-capital-investments/

[…] Emirates Driving Company Pitch Discounting & M.O.S Google Pitch Share Repurchases BV v. IV Importance of Returns on Capital Activision Arbitrage? Inflation & Equity Returns Adobe Economics Credit Acceptance Economics […]

LikeLike