The effects of Russia’s invasion of Ukraine are contributing to an economic downturn across Europe. In response to governments across the continent sanctioning Russia, Moscow has retaliated by cutting natural gas deliveries into the European Union. For many years, Western European nations assumed that regardless of geopolitical issues Russia would be a dependable source of energy. Throughout 2022 it has proven not to be the case.

As the end of summer nears, European energy security is clouded with uncertainty for the winter to come. Worries picked up after Gazprom cut Nord Stream pipeline gas flows from 40% to 20% in the backend of July, sighting problems with turbines. The Nord Stream pipeline is the main point of entry of Russian gas into Europe and at full capacity could supply enough gas to satisfy 10% of the European Union’s annual consumption. Without Russian gas, European industries will be hit hard and may end up rationing gas in the winter.

The German government has taken a 30% stake as part of a larger $15.3 billion (15 billion euros) bailout of energy giant, Uniper. Uniper had found itself bleeding cash as it was forced to buy supplies from the highly-priced gas spot market after not receiving the contracted gas volumes from Gazprom. The bailout also includes an increase in the credit facility for Uniper to 9 billion euros (previously 2 billion) at state-owned KfW bank. Uniper shareholders would also be involved in the bailout as the plan would see their ownership interests diluted, a ban on dividends, and a cap on executive compensation. Finnish majority-owner Fortum had an 80% stake before the bailout, it now only holds 56%.

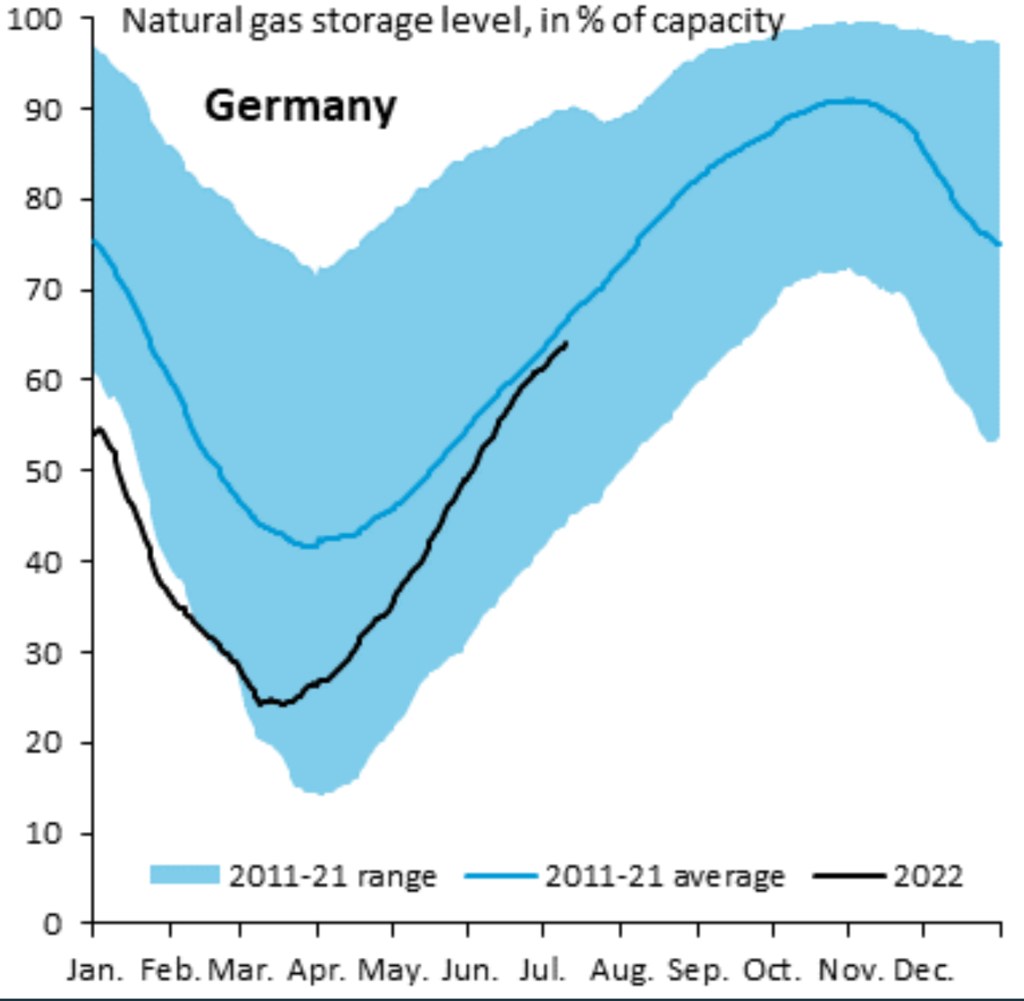

Germany usually likes to keep its gas storage level at around the 90% mark by late fall, going by the past decade. With Nord Stream running at 100%, this level would comfortably get Germany through the winter. However, Nord Stream is only running at 20% right now, meaning it is almost impossible for storage levels to even hit the 90% level in time for the winter. Without Russian cooperation to drastically increase gas supply it is looking very likely that Germany will have to ration its gas for the winter months.

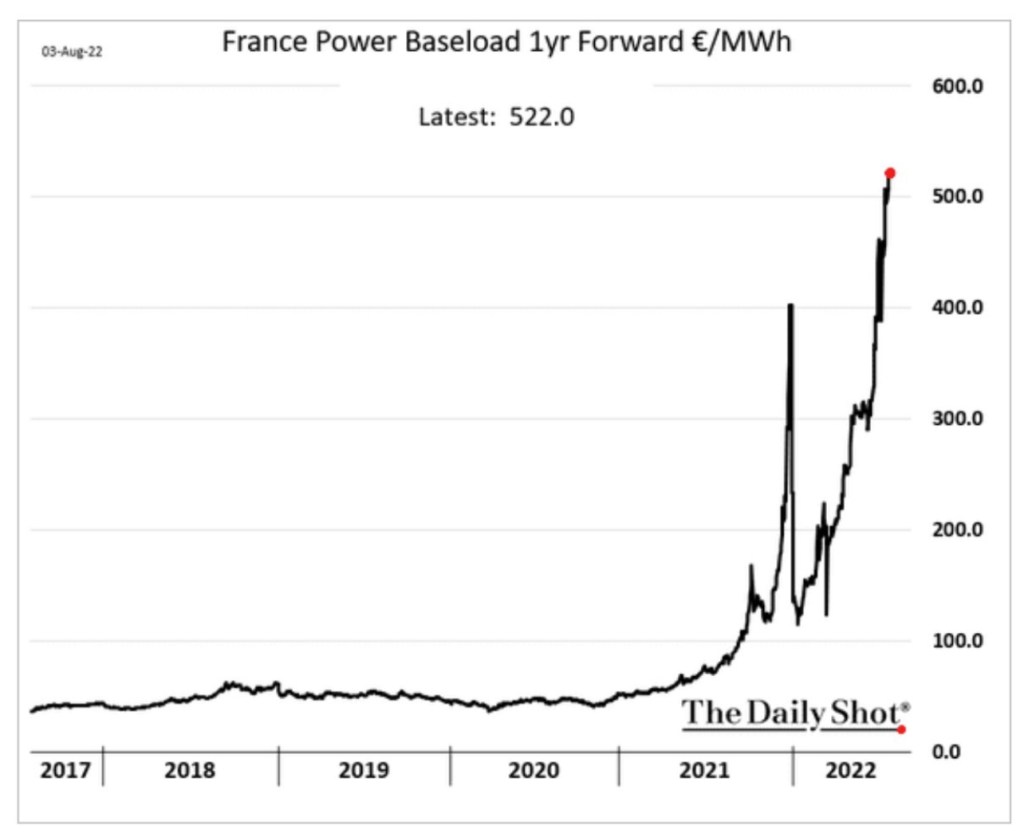

In France, the government offered to nationalize the EDF, the largest owner of nuclear power plants in the world. The Finance Ministry tabled an offer at €12/share (a 53% premium to market price at the time). The French government’s decision comes at a time where the EDF is operating at a loss as a result of government caps on electricity prices. Additionally, the EDF also had to shut down 12 of its nuclear reactors (total of 56) for maintenance due to unanticipated corrosion.

As a result of Russia’s unreliability, European countries are looking for alternatives in North Africa and the Middle East. Agreements between the producers and Europe are filled with complications. Qatar looks like the best bet for the European countries but negotiating the concessions of such an agreement will require significant time. The European Union had launched an antitrust investigation into Qatar’s restrictions on reselling gas as it limits cross-border trade – the probe has since been dropped. Other points of contest have been over the length of contracts and the pricing due to Qatar’s distance from Europe. Other nations in Northern Africa (ex: Algeria, Libya) are by most not considered viable due to the accompanied political risk.

Politicians in Europe have began calling to lift the Russian sanctions, hoping to ease the energy crisis their people face. As usual, this is an issue most political parties are unable to agree on.

[…] Equity Returns Adobe Economics Credit Acceptance Economics Google Economics QE & Money Creation Europe’s Energy Crisis EM Crisis (1) EM Crisis (2) An Immutable […]

LikeLike