In 1998, Larry Page & Sergey Brin founded Google. The company since then has grown to be one of the most valuable brands in the world. The company has lost roughly a fifth of its market value from its recent high due to fear of competition through AI disruption. Google is a company I’ve always admired and have now had the chance to dig into the business deeply and determine if there is any value.

Opportunity

Market sentiment around Google is not filled with the same confidence it had a year or two ago. The rise of OpenAI’s ChatGPT has had investors worried that Google’s impenetrable moat may no longer exist due to advances in AI and the emergence of Bing in companion with ChatGPT. Google shares have lost 10% of its value in the past year with volatility running rampant in that period. I believe that the company has not lost its moat and will continue to be the leader resoundingly in the search engine market. I believe Google’s entrance into the cloud has a long runway of growth. I believe the company will still be able to compound its earnings for long to come and reinvest a fair share of said earnings back into the business in the coming years whilst reducing share count through its repurchase program.

Introduction

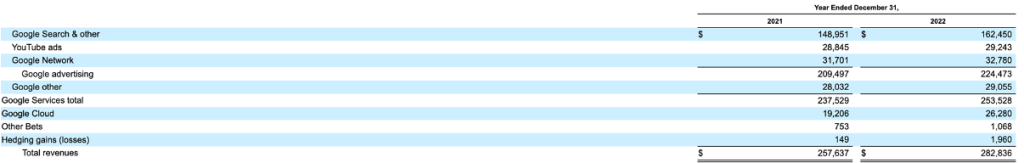

Alphabet (Google), is one of the largest companies in the world and today trades at a $1.2 trillion market cap (enterprise value of $1.1 trillion). The business can be split business into 3 main segments: Google Advertising, Google Others, and Google Cloud. The majority of Google’s revenues come from its advertising business, specifically Search and Youtube, their owned properties, with Google Network Partners accounting for the remainder. Google Others consists of hardware products (ex: Nest & Pixel), non-advertising YouTube revenues, and Android/Play Store revenues. Lastly, Google Cloud, is comprised of Google Workspace (ex: collaboration enterprise tools) and Google Cloud Platform, its infrastructure and platform services – the company’s answer to Microsoft’s Azure & Amazon’s AWS. The Cloud platform is still relatively young and has much more revenue ahead in its future.

Google’s Moat

Google’s advertising business accounts for 80% of total revenues ($224B). The advertising business is home to Google’s deepest moats. To explain the source of Google’s moat in online advertising it is important to recognize how the advertising auction markets work.

The advertising market works as follows. Each time a user visits a website the ad space on the site is routed onto the Ad Exchange. In the exchange, the ad space on the site is in real-time auctioned off to the highest bidder. By the time the auction concludes, the advertiser has their ads displayed to the user before they can notice anything has occurred. See image below for graphical representation of the process.

Google’s key advantage in the auctioning markets is their control of intermediary tools used in ad inventory & the advertiser network, whilst maintaining control of the primary ad exchange used in the market. Google sells its own ad space as well as third party (Network Members) ad space on the exchange. The share of Google site revenues a a percentage of total revenue has been increasing over the past decade. This is a promising sign as the cost of revenue on Network member revenues is much higher than being effectively non-existent with their owned properties.

The main advantage realized by Google through the ecosystem they’ve built is a speed advantage. As both the exchange and intermediary tools (Google Ads & DV360) used to bid on ad space are located near one another. Advertisers will look towards Google as their intermediary of choice and the company take its share of the ad dollars.

In all, Google houses the largest publisher ad inventory (DoubleClick) which makes their intermediary tools and ad exchange far more valuable as well. Any potential entrants into the space will need to convince advertisers and/or publishers that their platform can outdo Google in speed or effectiveness in the bidding process – a near impossible task. Google is able to rely on network effects to widen their moat. This is best illustrated in ad bidding and through YouTube. The network attracts people to join and equally pulls them into staying on with Google. As the network grows the moat widens with each additional publisher.

Google’s Runway

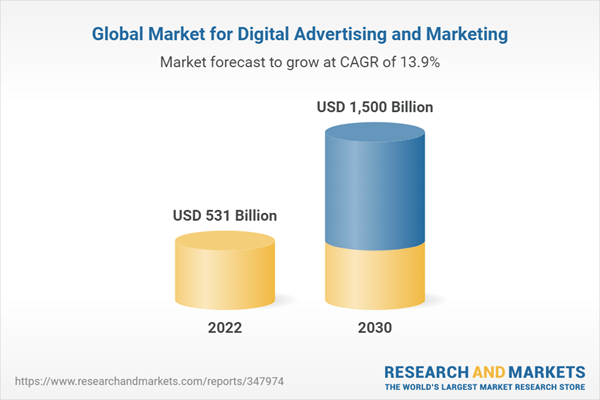

When looking at Google’s size one has to question the runway and just how much more can the company grow. I believe the company still has a sizeable runway in advertising and the cloud. The digital advertising market is expected grow at 14% over the next 8 years before amassing a size of $1.5 trillion. Google is placed well to continue to capture the growth in global market over the years through Search & YouTube. There will undoubtedly be more players in the advertising market as the likes of Amazon & TikTok grow in the market. The sheer size of the market however will still provide Google with a long runway in digital advertising.

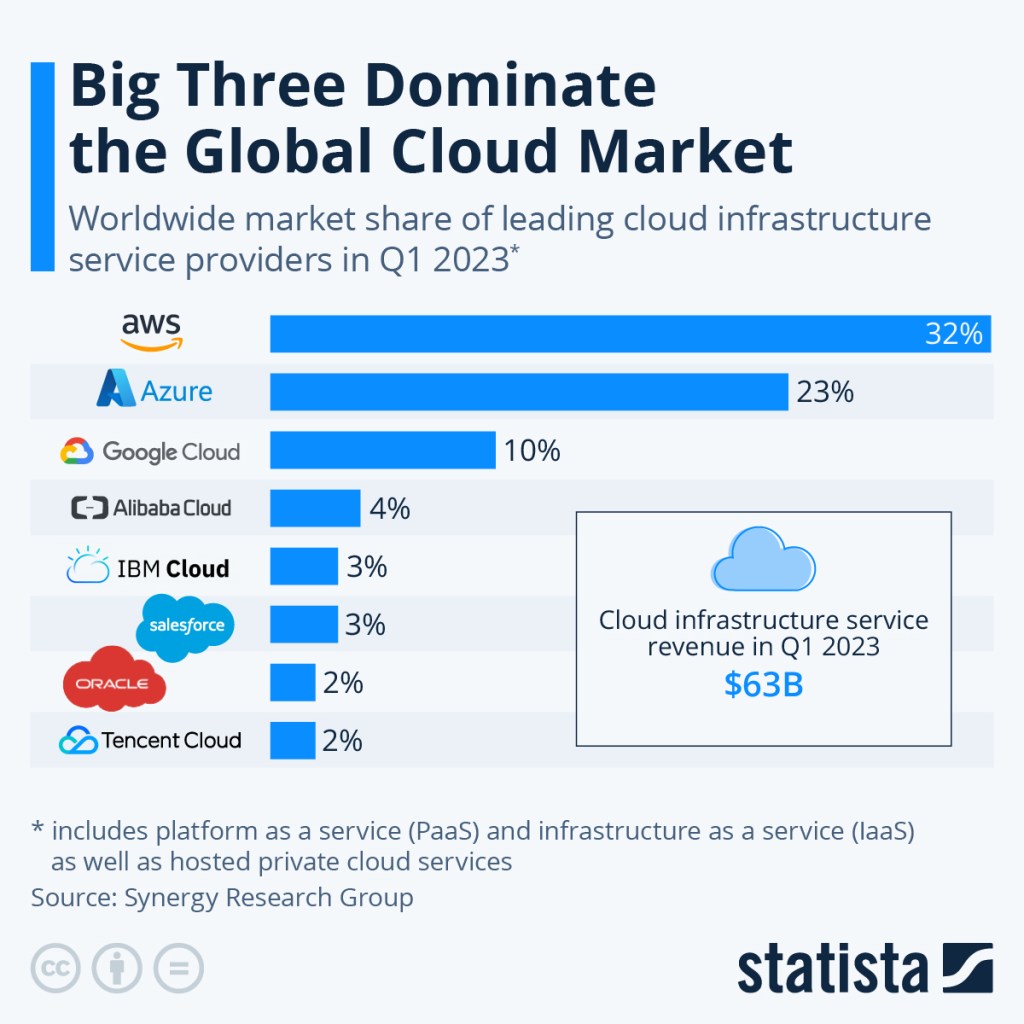

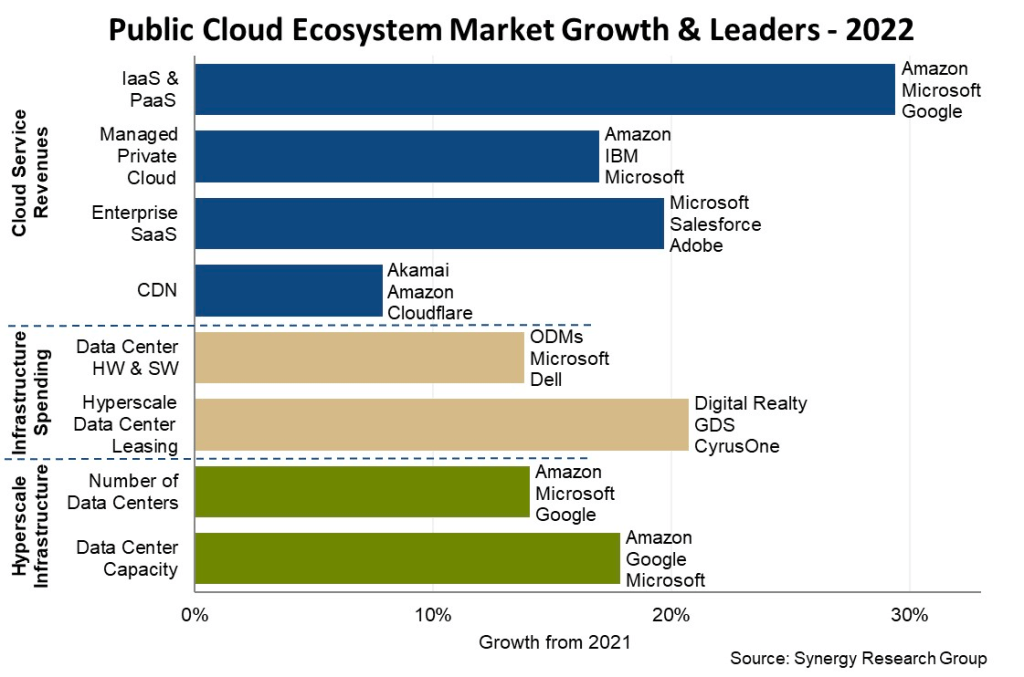

The Cloud

Google’s second opportunity to grow is in their cloud business. The company lags behind Microsoft and Amazon in this market but there is more than enough room for all businesses to continue growing their revenues for years to come. Over the past five years, Google Cloud has grown its market share from 7% to 11%, with only one down year. In that time revenue in the Cloud segment has shot up from $4 billion to $26 billion in 2022 (a 6x in 5 years!). I’ve also noticed a trend in the cloud infrastructure market; the hyperscalers (Google, Amazon, Microsoft) seem to be consolidating market share as the years go by. In 2017 their combined market share was 53% and just last year it was up to 66%. The cloud market has shown resilience over the past year growing at over 20% despite headwinds. The growth opportunity in cloud for Google cannot be understated and will definitely be a major revenue driver for the company in the years to come.

Valuation

The company has a ROIIC (return on incremental invested capital) over the past ten years of 30%. In that time, the company has generated a cumulative $367 billion in operating earnings, increased their invested capital base by $206 billion, and increased operating earnings by $62 billion. I estimate that 56% of operating earnings is reinvested back into the business. I believe a company that can generate that level of return whilst reinvesting over half its operating earnings is the key to value creation for the continuing shareholder.

On its free cash flow generation, I’ve made a few adjustments to calculate a measure that I believe to be a more conservative and closer to reality measure of cash flow (owner earnings). I’ve calculated it to as operating cash flow plus fines less stock based compensation and the maintenance level of capital expenditures. In the ten years from 2012-2022, this measure has increased from $10 billion to $53 billion, a CAGR of 17%.

The company is currently trading for $104.50 per share, implying that we would be paying 18x earnings (net of cash) for a company that has delivered high returns on capital, steady margins, and a has a huge runway in its key business segments. There is still so much growth left to uncover that I think at the current price we get a fair deal for a terrific company.

As per my owner earnings calculation, in the year 2022, company generated about $53 billion in earnings which would imply an earnings yield (net of cash) of 4.23%. In comparison, the ten year treasury yields 3.48%. The difference between the two yields is slim and not a proper account of a large margin of safety which I believe is made up in the quality of the business and the attractive opportunities it has to deploy capital back in operations.

In my estimation, the company has loads of growth ahead of itself in cloud and advertising, loads of free cash flow generation and will continue to buyback is shares; making use of its enormous cash pile. I believe that the per share earnings of Google can grow to $7.50 per share in the next five years and still have a sizeable runway ahead of itself. Should the market provide a rerate on Google’s earnings back to 20x earnings (historically traded for mid 20s) after realizing that ChatGPT and other LLMs aren’t the value destructive threat they appear to be, we could be looking at a business worth in excess of $150/share. This represent a near 47% premium to current market prices. I expect Google to reach $7.50 in EPS by 2027FYE, representing a 12%+ IRR from current prices – fueled by share count reductions and earnings growth at high incremental margins.

Risk

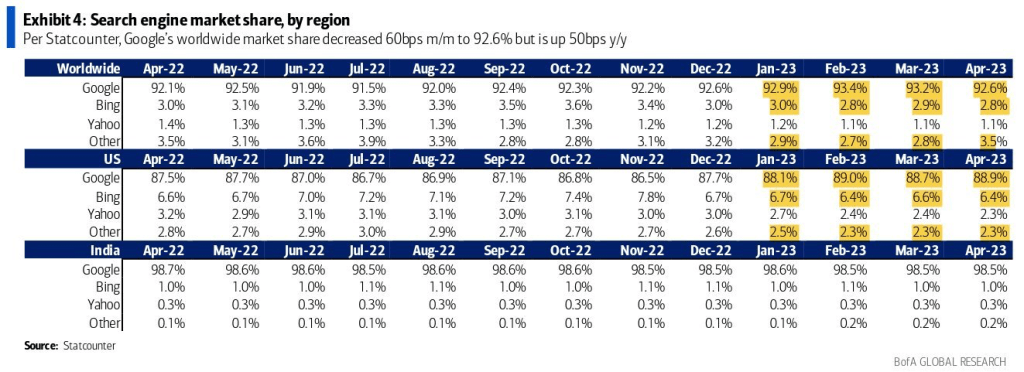

It is almost inappropriate nowadays to speak of Google without mentioning artificial intelligence. The general fear around Google is that their supremacy in search will come under fire as a result of developments in AI, specifically through Bing’s partnership with OpenAI/ChatGPT. While I do believe that AI will change the way we access information I am not of the belief that AI (AGI, specifically) chatbots will overcome Google Search’s dominance as the search engine of choice. Firstly, AI has always been here and improving Google’s advertising efforts and effectiveness in search. On that front, this is just the next step. I also believe that chatbots are not true disruptors to Search, but additions necessary to remain competitive. Recent data from Statcounter shows that YoY, Google’s market share actually grew, in spite of Bing integrating ChatGPT (their market share dropped) into the search engine.

I think when it comes to AI, it is important not to be too swept away by its perceived novelty. I believe that Google’s distribution ability and data puts the company in a position to remain the dominant player in the search engine market and integrate AI into the platform as needed. I struggle to see where a competitor can beat Google’s brand, data and distribution prowess on this front, perhaps a first-mover’s advantage may allow them to ‘win’ in the short term. However, in the long run Google is well positioned to maintain its dominance.

Summary

I find that neomania can be the enemy of the investor and I believe that is the case at Google today. The market has in the past few months let negative sentiment hinder its vision. Despite what commentators may think, Google does not resemble an AI lose to me, but, may actually be able to integrate appropriately and improve the returns on their ads business. If you were to look at the business over the next 3-5 years you will see that Google is in position to grow its earning power for the years to come. There will be short term challenges to keep its reputation and brand value but without doubt the economics of the business are favourable.

[…] Margins TSMC Pitch Railroad Industry Primer Emirates Driving Company Pitch Discounting & M.O.S Google Pitch Share Repurchases BV v. IV Importance of Returns on Capital Activision Arbitrage? Inflation & […]

LikeLike