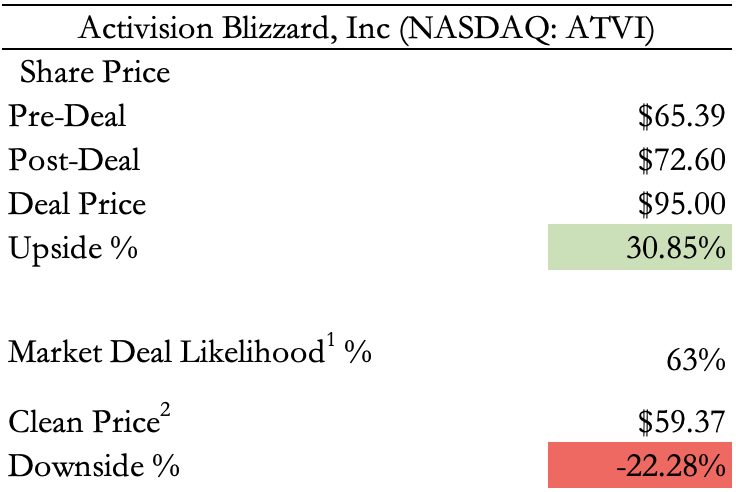

On January 18, 2022, Microsoft (NASDAQ: MSFT) announced their plans to acquire Activision Blizzard (NASDAQ: ATVI) for $95.00 per share, an all cash deal valued at $68.7 billion, inclusive of Activision Blizzard’s net cash. Should the deal close Microsoft Gaming would become the 3rd largest video game provider by revenue (behind Tencent & Sony). Microsoft hopes to close this deal by June 30, 2023, its fiscal year end. This acquisition serves as a chance for Microsoft to continue growing its gaming business on PCs, mobile phones, and consoles. However, Activision shares currently sit at $72.60 per share, representing a 30.85% upside should the deal close. Interested in this opportunity, I’ve decided to write here some of what is known of the deal and will attempt to judge the probability of the deal closing.

The Target

Activision Blizzard is one of the world’s largest video gaming publishing companies. The company owns some of the world’s most well known franchises in gaming. The Blizzard Studio houses: “Call of Duty”, “Overwatch”, “World of Warcraft”, “Diablo”, and many more. Additionally, the King Studio has “Candy Crush” and more mobile games to its name. Prior to the announcement of the deal at the turn of the year, shares saw an intra-year drawdown of over 40% in 2021 from a peak at $103 per-share. This drop was largely due to lawsuits filed against the company alleging sexual misconduct committed by executives. Over the years, Activision has been berated for its handling of sexual harassment allegations and its lack of change to remedy the problems within its workplace.

Come January, Activision shareholders quickly saw a turn in their fortunes when Microsoft announced its planned acquisition of the company for $95.00 per-share. But as I introduced earlier, shares have not climbed to that level representing the risk, mostly legal, of the deal failing to go through. I will now go over what UK & EU regulators are saying about the deal.

Legal Worries

According to Reuters, the European Commission’s biggest worry with this deal is whether Microsoft would be incentivized to block competitors off from Activision’s array of games and if that should occur, if there would be enough suppliers in the market afterwards. The EU regulators have already probed competition to find out if the acquisition would give Microsoft a competitive advantage in publishing & distribution of games across all platforms, from the user data they would receive. Game developers & publishers are also being considered as to how a deal would affect their bargaining power to sell games on Xbox and through the Game Pass (Microsoft’s Cloud Gaming subscription service). Other regulatory worries surround the “Call of Duty” franchise and potential effects of adding Activision to Windows OS.

The UK’s Competition and Market’s Authority (CMA) have continued their in-depth probe into the acquisition also being weary of the what could occur should Microsoft block rivals from Activision’s library. An area of great concern for the CMA is in the nascent cloud gaming industry, where the addition of Activision could damage competition for services.

It seems most authorities are only considering their local industry dynamics, which may prove to be a headache for Microsoft to get the deal over the line, as Tencent and other competitors may have less of a hold on certain markets.

Note: I have excluded the FTC from this discussion, as they tend to be rather toothless when it comes to stopping these deals. However, that could always change…

The Response

It seems to me that the most common concern behind the scrutiny of the transaction is the fear of Microsoft turning Activision’s library into Xbox exclusives entirely. But will this fear prove to stop the deal or is there evidence that the regulators will turn a blind eye to this. We already have precedent of Microsoft acquiring game publishers and continuing to make the games available on all platforms (also making a few exclusive, in fairness). On March 9, 2021, Microsoft finalized the acquisition of Bethesda Softworks (developer of Fallout & Doom) for $7 billion. Fast forward, a year from the finalization of the deal, Bethesda plans to release Fallout 4 in 2023 across all platforms, including close competition at Sony. Besides the size of this transaction what real change is there between the purchase of Activision and that of Bethesda? Here are a few words from the EU Commission after approving the Bethesda acquisition:

“The Commission concluded that the proposed acquisition would raise no competition concerns, given the combined entity’s limited market position upstream and the presence of strong downstream competitors in the distribution of video games” Source

I do not see any reason why regulators should fear this acquisition based on their prior approval of a similar transaction. The only difference discernible to me is the size of the deal, but when compared to the big two (in gaming revenues): Tencent & Sony, Microsoft + Activision only closes the gap in revenues and would still be around $2 billion short of Sony in 2nd place. Additionally, it is important to note that gaming has been a long continued trend of supporting cross-platform function. I do not see why Microsoft would fight against this trend, when previous acquisitions show it hasn’t done so and risk alienating potential audiences from the games they would develop themselves. Candy Crush, Call of Duty, and World of Warcraft made up 82% of Blizzard’s revenue for the fiscal year 2021, it is hard to imagine why Microsoft would make these games exclusive to its platform given the growth in cross-platform gaming. To me, it would be a misstep by Microsoft to turn the Activision library into Xbox exclusives and it would not make sense for them to do so given the rising popularity of cross-platform gaming.

The deal has already passed through regulators in Brazil & Saudi Arabia. What I found to be most interesting is what Brazil’s Administration Council for Economic Defense (CADE) had to say about the deal and Sony. Brazilian regulators wrote in response to Sony complaints:

“Furthermore, it is important to highlight that the central objective of CADE’s activities is the protection of competition as a means of promoting the well-being of Brazilian consumers, and not the defense of the particular interests of specific competitors” Source

The comments by Brazilian regulators are another reminder that as of current, this merger would only result in closer competition between Microsoft, Sony, and Tencent in gaming. Sony feeling most threatened by the deal due to the perks of their existing deal (ends in 2024) with Activision over the Call of Duty franchise have been the most outspoken against the deal going through. Microsoft has continued to reassure regulators of their commitment to keep the CoD franchise on all platforms past the 2024 deal end & release the CoD games at the same time on all platforms. I take the comments by the Brazilian regulators as another reminder of who is atop the gaming industry and how the Microsoft-Activision deal is not what it seems like at first glance.

The Deal

(1) Deal Likelihood is calculated using the current spread on the deal ($22.40) versus the total accretion of the deal from the market clean price ($35.63). The market’s assessment of likelihood should be the ratio of what is left to be accreted over the total accretion possible, which is 63% $(22.40/35.63).

(2) Clean Price calculated using pre-deal per-share price compared to the decline of the S&P 500 since (17.75%) using the target company’s beta, 0.52 (5yr, monthly). The clean price represents what the target company would be trading at today had there not been an offer tabled.

In the image above, I’ve presented the current situation of this merger and the potential gains/losses for an arbitrageur. It is obviously difficult to know the exact likelihood of the deal passing without having any strong legal knowledge in the matter. Microsoft has a terrific record of seeing out past acquisitions which they should hope to see continue here. The downside as implied by the calculated clean price would be a drop of 22.28%, should the deal fail to close. So, although the gain is handsome, the downside is not too appealing. In my mind, I see this deal following through in the UK, EU, and US for the same reason it has in Brazil & Saudi. Microsoft’s purchase of Activision, although large would result only in the closing of the gap in revenues from the 2 frontrunners in the industry, Sony & Tencent. So, I think the market’s hesitancy over this deal presents an opportunity that doesn’t come often. Thankfully, we won’t have to wait too long to learn more about this deal as we await a preliminary decision (either further probe by 90 days or accept) by EU antitrust regulators on November 8, 2022. Other antitrust regulators are still investigating with decisions to be made in the short future (UK’s CMA phase 2 investigation deadline is on March 1, 2023).

Well, those were just my thoughts on the deal. You can read more about the merger from these sources: https://www.reuters.com/technology/eu-wants-know-if-microsoft-will-block-rivals-after-activision-deal-2022-10-06/ https://investor.activision.com/static-files/180f309f-89e2-4fb8-a98d-b527edfdaf46 https://news.microsoft.com/2022/01/18/microsoft-to-acquire-activision-blizzard-to-bring-the-joy-and-community-of-gaming-to-everyone-across-every-device/ https://techcrunch.com/2022/10/13/activision-blizzard-is-once-again-being-sued-for-sexual-harassment/ https://www.cnet.com/tech/gaming/eu-scrutinizes-microsoft-acquisition-of-activision-blizzard/ https://xboxera.com/2022/10/05/brazil-becomes-the-second-country-to-approve-microsofts-acquisition-of-activision-blizzard-with-no-restrictions-xbox-activision/

[…] Discounting & M.O.S Google Pitch Share Repurchases BV v. IV Importance of Returns on Capital Activision Arbitrage? Inflation & Equity Returns Adobe Economics Credit Acceptance Economics Google Economics QE […]

LikeLike